The coronavirus crisis nearly brought personal vehicle traffic to a halt for several months across the U.S.

Many areas of the country had far fewer drivers on the road. Newspapers and magazines ran photos of desolate highways and deserted urban centers.

This decline in driving volume led to a drop in accidents and, consequently, a reduced frequency of auto claims.

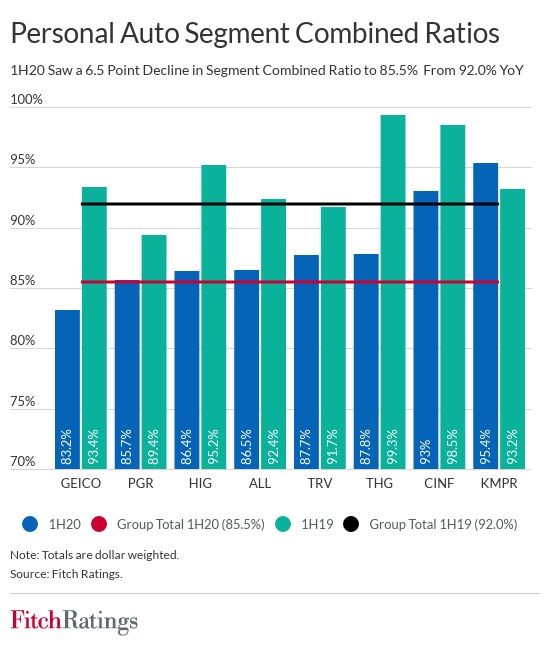

A recent Fitch analysis said that this reduction in claims frequency offset higher losses in other property & casualty insurance segments, such as business interruption, professional liability and workers compensation, and had a positive impact on first-half 2020 Personal Lines insurer earnings, even after many insurers returned a portion of the premiums to policyholders in response to the reduction in driving.

See Fitch’s chart on combined ratios for the personal auto segment below, and their analysis at Auto Insurer Profits Driven by Record Drop in Claims Frequency and Personal Line Insurers’ Profits Continue Despite Coronavirus.

Insurance Journal discusses the Fitch reports, putting the impact of reduced losses in context

“Personal lines insurance is the largest major segment of the U.S. P/C insurance market, with approximately $344 billion (54% of total industry premiums) in 2019 written premiums.

Personal auto insurance premiums represent more than 2.7x homeowners insurance volume for the industry. Personal lines net written premiums growth slowed to 3% in 2019, from an average rate of 6% from 2015-2018 as auto premium growth diminished.

According to Fitch, personal lines posted a 98.7 combined ratio in 2019, less than 1 percent better than the 99.4 combined ratio produced the year before. For personal auto, at least, Fitch expects the combined ratio to improve by a few points, which would drive the overall results for the broader personal lines sector.”

However, Fitch notes that driving is returning to pre-lockdown levels and that the “improved short-term performance of auto insurers is unsustainable.” Also, Insurance Journal notes that there has been some outcry by consumer groups that insurers did not return a sufficient amount to consumers, and there is a call for better oversight by state insurance commissioners.

What does this mean for insurance agents?

-

Despite the difficult economic climate surrounding the pandemic, reduced personal lines losses should drive P&C profitability for major insurers in 2020

-

Expect the market to continue hardening

-

Agency profit sharing should be strong this year, but expect the gains realized by the drop in claims frequency to be a short-term phenomena.

-

Renaissance is projecting a banner year for profit sharing for our members. Here’s how you can take advantage while there’s still time.

Bill LaGram

Senior Vice President, Carrier Partnership Management