Why insurance agency benchmarking delivers insights that can drive revenue.

While many independent agency principals have an excellent handle on the ins and outs of their business, they can gain a competitive advantage by measuring their performance against other agencies in their region.

As driven entrepreneurs, agency owners make it their mission to stay on top of their business’ growth rate and their expenses, knowing which clients represent the greatest percentage of revenue, and other important details. By and large, agency principals possess a highly informed perspective – and forward-looking owners know there’s always room for improvement.

To truly understand how their agency is performing, however, principals need to know how their business stacks up against those of their peers. That’s where insurance agency benchmarking comes in.

For example, when comparing your business’ performance to other agencies, you may discover that your expenses are in line with others, but your productivity has slowed. As a result, you may decide to invest in your agency by hiring producers who will enable you to bring in new types of clients; adopt new workflows that can streamline your agency’s processes; or utilize new technology tools that can help your agency make more money.

Benchmarking your insurance agency against others doesn’t just highlight your strengths: It reveals the areas in which you can redirect your efforts to grow your business.

Here’s what you’ll be measuring

The types of insurance agency benchmarking data that will prove most useful are key metrics of performance and value. This includes your agency’s:

- Account Growth (year-to-date)

- Premium Growth (YTD)

- Policy Growth (YTD)

- Commission Growth (YTD)

- Production Rate (new accounts/total in force)

- Account Retention rate

- Customer acquisition cost (CAC)

- Number of producers, their average compensation, and average comp as a percentage of your book

These and other metrics will help your agency identify new areas in which you can concentrate your resources.

Next steps to insurance agency benchmarking

There are several different ways in which you can effectively benchmark your insurance agency against others in your area.

One way to start is through open discussions with other agency principals who feel comfortable sharing such information with you. This is particularly helpful when the agencies you’re comparing against are of equitable size to your own.

To get the most out of this type of benchmarking, it’s important to expand your personal circle of fellow agency owners. Begin by leveraging your existing contacts with other local agencies; then, conduct some research to find LinkedIn or Facebook groups of agency owners and join the ones that appeal to you. Regional associations will provide similar opportunities to network with other principals.

Expert research is especially helpful. Throughout the year, boutique and large consulting firms publish whitepapers and studies that offer insight into the challenges of independent agencies.

Regan Consulting and the Big “I” conduct the yearly Best Practices Study, which compiles benchmarking data on key metrics of agency performance and value including revenue growth and profitability, financial stability, expense management, and sales and operations productivity. National Underwriter Property & Casualty magazine and the National Association of Professional Insurance Agents (PIA) co-publish the annual Independent Insurance Agent Survey of agents that presents agents’ feedback on a variety of operations-related topics.

Additionally, you may consider joining an agency network, which (among other benefits) enables you to become part of a community in which you have regular opportunities to share best practices with other member principals.

Renaissance Alliance is an agency network that focuses on helping agencies discover growth opportunities in their businesses. One way we do this is through the Renaissance Technology Platform, which analyzes your agency’s data and compares it to that of similar agencies.

With the network’s assistance, Renaissance members gain a deeper understanding of the different ways in which they can expand their business.

Assess your agency through 4 key measurements

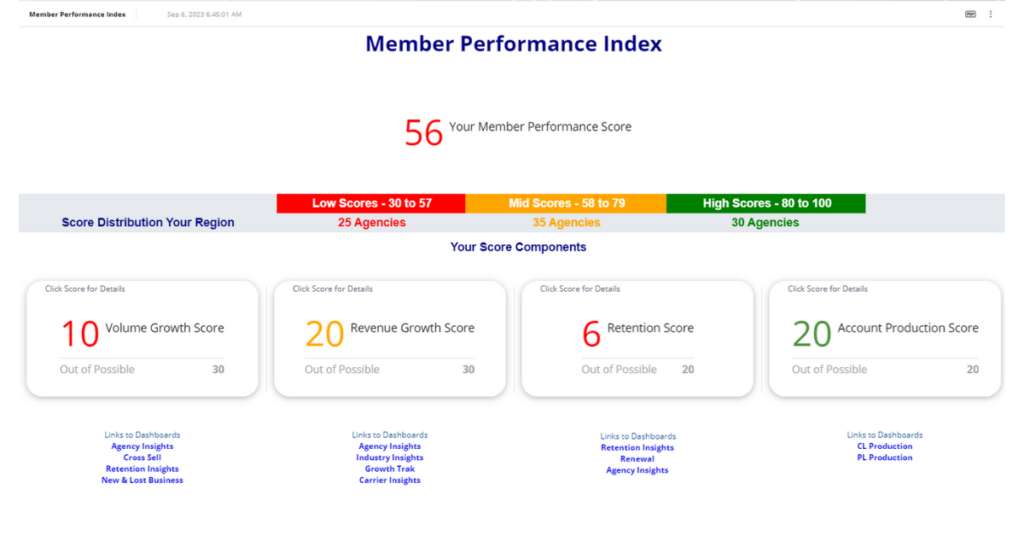

Renaissance members receive a customized, highly detailed assessment of your agency that measures you against your peers. Renaissance’s Member Performance Index (MPI) helps immediately identify where your agency is outperforming other agencies in your area, and where there’s room for improvement.

A newly launched product, the MPI was forged in response to feedback from member agency principals eager to gauge their performance against other agencies in their region.

The MPI scores your agency in four key areas:

- Account & policy growth

- Revenue & premium growth

- Account production

- Account retention

These metrics are the basis for your agency’s overall assessment, which you then use to see how you measure up against the top-performing member agencies in your region.

Armed with this knowledge, you can:

- Use your peer performance in each key area to pinpoint where you want to improve and create an action plan to achieve your goals

- Ensure you are allocating agency resources and effort into growth areas with the biggest upside

- Develop incentive programs for your producers based on the areas in which you want to improve

Then, once you’ve identified your biggest areas of opportunity, you can:

- Dive deeper into your data and trends, using the MPI’s detailed dashboards

- Work closely with your Agency Growth Partner to develop a plan to achieve your goals

- Chart your continued progress over time

Insight Helps Drive Revenue

Even if you possess the most thorough understanding of your agency’s data (and even if you personally consider your business a success), the ability to compare your performance against your contemporaries and industry benchmarks helps you see where you have opportunities to grow.

On its own, your agency data can only show you so much; in a comparative equation, it is cast in a much different and more valuable light.

While discovering how your business’ performance measures up against that of fellow agencies, the knowledge gained can empower you and your staff to focus on the areas that will help your agency gain more revenue, create value, and improve your financial stability.