In the first days of the great coronavirus (COVID19) shutdown, virtually all business came to a grinding halt in a scope that has never been seen in our lifetimes. Initially the closures were positioned in terms of weeks or perhaps a month, but now it is clear that disruption will continue for a significantly longer time. Agents whose first order of business was to set up technology-enabled remote offices to serve their insureds are now adapting to the uncertain realities of the situation. Here at Renaissance Alliance, we think it’s time to move forward, to assess where we are at as an industry, and what independent agents can expect in the days to come.

To help us in this assessment, we reached out to five CEOs of key carrier partners – top regional and national property and casualty insurers. We wanted to take their pulse on what this sort of crisis might mean to the industry going forward, particularly the personal lines and the small commercial segments. We asked these partners to reflect on lessons learned from prior catastrophic crises, such as 9/11 and the great recession of 2007-2009, and to apply those lessons to our current scenario. While these past events had similarities in terms of global slowdowns, restrictions on travel, and serious impacts on certain industry segments, the current crisis is seen as bigger and broader in scope than anything previously experienced. Nevertheless, these experiences can inform the business view for both our short-term and long-term future.

Our partners were relatively consistent in anticipating that we will continue to be in a significant environment of slowdown, social distancing, and semi-lockdown for anywhere from 45 days to as much as 150 days.(Interviews were approximately 10 days prior to this publication) Should things lean to the shorter end of the spectrum, the optimistic scenario is that business might bounce back to a thriving economy relatively quickly, within 6 to 9 months. In the more likely scenario of a longer disruption, carriers see the potential for a mild to a serious recession that could last anywhere from 12 to 24 months, or perhaps longer.

Viewing these scenarios in the historical framework of how their insurance companies had experienced prior catastrophic events, they offered perspectives on what we as an industry might expect.

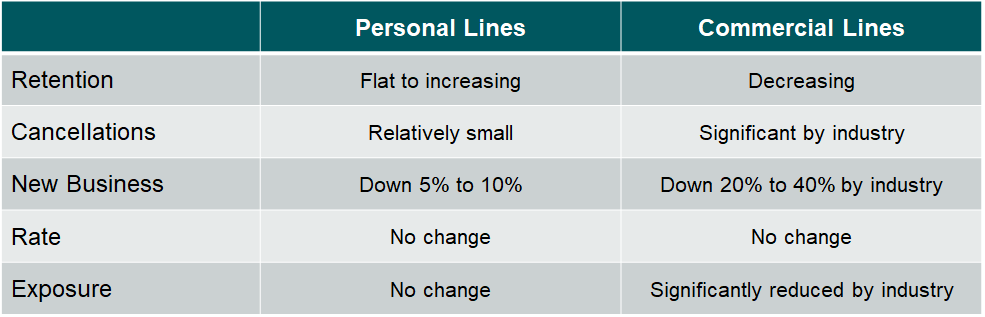

Perspective on Personal Lines: Based on prior experience, they see that the personal lines business is likely to be sturdier, more stable, and more consistent than the small commercial segment of the business. Retention will hold steady and may even increase. They do not anticipate cancellations to be a large issue for auto or homeowners, partially due to regulatory reasons people need these types of insurance. Where they do see a potential uptick in cancellations is in ancillary business such as boats, motorcycles, or even umbrella policies as insureds reevaluate financial priorities and tighten belts; however, this business segment represents less than 10% of premium. New business is expected to be down, in a range of 5% to 10%, but a strong focus on retention is seen as a potential offset. Overall, the perspective is that personal lines held up reasonably well in past crises, and they anticipate similar in response to the current environment.

The View for Commercial Lines: From a commercial lines perspective, our partners were considerably less optimistic, particularly around certain industries, such as hospitality, transportation, and small service businesses, as well as for certain product lines, such as workers compensation. These sectors could drop by 50% to 70% due to both cancellations and virtually no new business. They anticipate an overall decrease in retention and an increase in cancellations associated with entities going out of business. New business is expected to be down by as much as 20% to 40%, depending on the business segment. Businesses that are not closed or put into bankruptcy will have dramatically lower workforces and dramatically lower revenue numbers. This will have a serious impact on premium.

Rates: For both personal and commercial lines, rates are expected to hold steady. Most of these entities indicated that they are planning to stick with the 2020 rate plans that they had put in place last December or in January. They don’t see changes to those plans.

Losses: On the positive side, claims and losses are trending down in both lines. In personal lines, auto claims are already down 30% to 40% just in the initial weeks and are expected to continue trending down. The jury is still out as to the loss effects on homeowners insurance: will increased time in the home raise or lower claims? As for commercial, there is certainly a view that many of the claims around businesses for certain lines will also go down. Consequently, profitability will improve as loss ratios strengthen.

Summary: Our CEOs saw difficulties around new business in personal lines, but felt otherwise, it should hold up relatively well. In commercial lines, the difficulties are associated with cancellations, lack of new business, and lower exposures, particularly associated with certain industry groups. Profitability is viewed positively, leading to the prospect of enhanced profit sharing, which may offset the lack of premium and lower revenue numbers for the near term.

Future Flight to Quality: The carriers were also looking beyond the financials to assess how this terrible crisis is likely to affect customers. They predict a flight to quality, not simply defined as financial strength, but also as the resiliency to seamlessly provide high quality services in virtually any environment. Those carriers who have invested in technology are well positioned to deliver on flexible, adaptive high-quality service. This crisis will underscore not just financial strength but business strength through use of technology – a lesson that is equally important to the independent agent. We agree with this perspective and see Renaissance Alliance members are well positioned in this regard. We would also encourage agents to increase communication with insureds in both traditional ways and in social media, positioning themselves within the current environment as guides, trusted consultants, and local business partners. The current environment is creating disruptions for all, but disruption creates extraordinary opportunities.

COVID19: Framework for your agency’s future

We all know the formula: Premium drives revenue, revenue drives cash flow, cash flow drives the financial strength of your insurance agency. To help you assess how the current environment is likely to affect your business, we’ve developed a template that maps five key levers that drive premium across the business into two sectors, personal lines and commercial lines. (See chart below) It looks at the key drivers of premium: retention, cancellations, new business, rates, and exposure. Typically, we’d lump cancellation into retention, but we’re calling out cancellation specifically because of the potential in the commercial lines sector for a significant portion of businesses to just disappear.

Use this template to project your agency’s business: Our template is designed to help you think about your business and try to project how this environment may impact you over the next three, six, nine, and 12 months so that you can determine how you may need to react. We hope this is helpful to all independent agencies. For member agencies, your Agency Growth Partner can help you think this through and plan strategies for retention and even growth. For non-members, we are happy to have a conversation to help you think through your agency’s unique challenges going forward.

Seize opportunities in the CARES Act: We urge you to run, not walk to your current bank or credit union to take advantage of federal grants and loans available through the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act. Our recent blog post on the CARES Act provides critical information that you need to know about these relief and recovery programs available to you and your commercial insureds. A word of caution: you need to act quickly as there is high competition for a finite resource.

Tap in to our many COVID19 emergency agency resources: We’ve developed a resources repository that centers around industry information you need during the COVID-19 crisis. It includes legal and regulatory information, as well as resources from every carrier that we’ve received a piece of information for that allows us to organize it by each company. Normally, this type of resource would be housed in our members-only portal, but we’re making it available freely to all because we feel strongly that it is important for us to work together as an industry during this crisis. See: COVID19 Insurance Agency Emergency Resources. We also urge you to follow our Insurance Agent blog for resources, tools, videos and more. We will continue to share relevant and hopefully helpful information for agency owners as the situation changes rapidly. We are here for you, and encourage you to reach out to me personally, or any member of the Renaissance team, if there’s anything we can do to help. Be well.

Kevin R. Callahan, Executive Chairman

Connect with Kevin on LinkedIn