As carriers continue to hit pause on writing new business in the Golden State, options become increasingly limited for independent agents.

By Rene Swan

Insurance availability in California is reaching an inflection point for carriers, consumers, and elected officials alike, fueled by the collective impact of wildfires, economic conditions, and actions (or, critics say, inaction) by the state’s department of insurance.

Since March, at least four major insurers have stopped writing business in several key lines of both personal and commercial business. As a result, consumers have found themselves with fewer viable options for homeowners and personal auto coverage in particular – and for those living in wildfire-exposed areas, the rates for the limited cover available to them are priced exceedingly high.

The availability of homeowners coverage is especially threatened in areas within the wildland urban interface (WUI), in which most admitted carriers will no longer write policies. Wildfire losses have been particularly devastating in the Golden State over the past seven years, during which more than 55,791 wildfires burned 11.2 million acres to the tune of more than $31.9 billion in insured losses.

Given the considerable amount of losses from wildfires alone, one might expect that the state would make it easier for insurers to charge appropriate rates for at-risk areas. Repeated attempts to secure rate increases, however, have been denied by the California Department of Insurance, whose detractors say has maneuvered even the state’s largest admitted-market insurers into an impossible position.

“California’s insurance department has a responsibility to prevent inadequate rates, and they’re ignoring that,” says Steve Young, senior vice president and general counsel for the Independent Insurance Agents & Brokers of California (IIABCal). “Our members tell us on a daily basis that it’s the worst availability crisis that they’ve ever seen. If you’re an independent agent, you have no way to protect your clients.”

Due to an initiative passed in 1988 that was intended to protect consumers, when carriers apply to the state’s DOI to raise rates by 7% or more in personal lines or 15% or more in commercial lines, they can face an “intervenor” in a public hearing (which are sometimes delayed for up to two years) to decide whether the rates are warranted.

Since insurers face a considerable burden of proof, they often seek to avoid those hearings and ask for increases just below the thresholds that trigger a public hearing. Even in such cases, however, the road is long for having any approvals granted – and the rate increases achieved are often inadequate by the time the approvals come through, which can make it inadvisable for insurers to continue operating in California.

Pause for Effect

Earlier this year, Nationwide made it known it would pause writing all new business in California for Nationwide Small Commercial effective March 31. State Farm then announced on May 26 that it would stop accepting applications for all business and personal lines of property & casualty insurance, citing inflation, a challenging reinsurance market, and rapidly growing catastrophe exposure.

Allstate – which in previous months had stopped writing select P&C lines without a formal announcement – followed suit, officially stating it would pause new homeowners, condominium, and commercial insurance policies, citing the impact of wildfires in addition to higher repair costs for damaged homes.

In July, Farmers said it, too, was scaling back new homeowners insurance policies in California “to a level consistent with the volume we projected to write each month before recent market changes.”

Most recently, in late July, Liberty Mutual announced it will no longer offer businessowners (BOP) policies in California starting Oct. 1 – and non-renewals will begin in December.

Critics within the insurance industry say that the state department of insurance’s inability to approve timely and adequate rate increases is at the heart of the matter. They maintain that carriers have been prevented from achieving rates that take into account the sizeable losses of recent years – inflation, soaring reinsurance costs, outsized verdicts against insurance companies – that make writing business in California increasingly difficult and unprofitable.

“The California Department of Insurance is not approving the rate increases needed for insurance companies to remain profitable or even revenue-neutral in our state. This holds true for both property and auto, both commercial and personal,” says Chris Hebard-Summers, owner and business insurance specialist at Hebard Insurance Solutions in Loomis, Calif.

“The market was already hardening due to increased underwriting, and carriers have also non-renewed a huge amount of business in higher wildfire-exposed areas, which accounts for about 30% of the state. That has left a ton of property owners scrambling to get cover,” she adds.

Burning bridges: The Legacy of Prop 103

Members of the insurance industry maintain that California’s Insurance Commissioner, Ricardo Lara, is leveraging Proposition 103, which further empowers the California Department of Insurance to reject rate increases by carriers writing business in the state.

Prop 103 was intended to discourage rates that were excessive, inadequate, or unfairly discriminatory, and covers lines ranging from personal auto and dwelling fire to earthquake and homeowners, among many others. Now, says Young, the law is being applied against insurers in a vastly different environment than that which existed when the law was passed.

Young recalls that on April 13, 2020, Lara – who is an elected official – “ordered” insurance companies to give refunds to drivers for their auto insurance. “With Californians driving fewer miles and many businesses closed due to the COVID-19 emergency, consumers need relief from premiums that no longer reflect their present-day risk of accident or loss. Today’s mandatory action will put money back in people’s pockets when they need it most,” Lara said in a press release by the DOI.

“It was a political stunt and nothing more, because he had no authority to demand that,” says Young. “He did get some nice headlines for it.”

Most carriers, Young notes, didn’t follow Lara’s order – and coincidentally or not, the DOI’s process of approving insurers’ rate requests has slowed.

In addition to the factors that contribute to insurance companies’ surging losses in recent years, California is the only state in the U.S. that does not recognize insurers’ reinsurance costs in the DOI’s calculations when approving rate increases. Insurers’ property reinsurance rates, meanwhile, have swelled by more than 60% since 2017.

“By definition, the department’s calculations trend toward rate inadequacy,” Young adds.

Wildfire risk ignites

One of the biggest factors contributing to California’s property insurance availability crisis is its considerable exposure to extreme wildfire. According to data compiled by the Insurance Information Institute, California has more than 1.2 million homes at risk.

Historically, homeowners had been a reliably profitable line in California. Since 2016, however, in California and other western states the exposure to catastrophic wildfire changed dramatically, driven primarily by a massive population shift into the WUI during years of protracted drought.

According to data from University of Wisconsin-Madison SILVIS Lab, California recorded a 39% increase in housing units in the WUI between 1990 to 2020. Today, approximately 5.1 million units reside within the WUI.

Critics point to severe forest mismanagement by local and state officials, as well as utilities such as Pacific Gas & Electric, which in 2022 agreed to pay more than $55 million to avoid criminal prosecution for two major wildfires started by aging Northern California power lines belonging to PG&E. The company has been blamed for more than 30 wildfires since 2017 that destroyed more than 23,000 homes and businesses and killed more than 100 people.

Hebard-Summers says that some of the carriers still writing policies in California have received approval for requested rate increases over the past several years, “which has caused property owners in non-wildfire areas to have their rates increased a modest amount – if you consider 10% to 30% modest – and wildfire-exposed properties have taken huge hits. But the rate the carriers have been granted wasn’t enough to return us to a healthy level, which has caused an exodus from the market.”

Straining customer equity

This is not to say that no options currently exist for California insurance consumers. However, their options are limited – and in many cases, in wildfire-prone areas the options that do exist are prohibitively expensive.

Michael Williams, president of Williams Insurance in Fullerton, Calif., notes that bundling coverage, especially for high-net-worth clients, has become all but impossible. For one such customer, who has a home in Yorba Linda (an upper middle class city located primarily in a WUI zone), he has had to remarket its property coverage four times since 2019.

“This is how my agents spend their day: puzzle solving – and it’s infinitely more difficult than it was four years ago,” he says. Premiums for high-net-worth homes, he continues, have skyrocketed due to wider maps drawn by the remaining markets that still offer coverage. “One high-value property that we insure renewed at $18K in 2018. Now, it’s about $160K.”

Williams says that to satisfy carriers, independent agencies like his are spending “historical” amounts of time and effort collecting more data than his agency has ever been required to.

“Their appetite is essentially zero; we have to provide them only top-quality risks,” he explains. “We’ve always supplied them good risks, but even those clients are undeservedly affected by the decisions of the DOI or by carriers. We’re trying to explain to clients who have been with us for 30 to 50 years why the very first time they have a lapse in coverage for 35 years or make an overdue payment, they get dropped.”

Additionally, there’s an educational quotient to his agency’s customer service process, he says, when explaining to clients that their efforts in shopping elsewhere are fruitless. “We know they need better options, but they’re looking in the wrong places. We spend lot of time teaching our agents how to access the equity pool of trust we’ve built with our customers.”

The result, says Williams, is that the lion’s share of an agency’s effort is spent on renewals rather than pursuing any new business. “We’re just shy of 98% retention, but that’s because our agents have had to place all their eggs in the ‘renewals’ basket.”

The only carrier that had held on with low premiums, he says, was State Farm. Now, it’s an entirely different ballgame.

The remaining carriers writing property business in wildfire-exposed areas are E&S insurers not regulated by the DOI, “so they can charge whatever they want – and that’s a lot more than the admitted markets,” says Hebard-Summers. “There are a few carriers still writing some home and auto in urban areas, but that list is shrinking every day.”

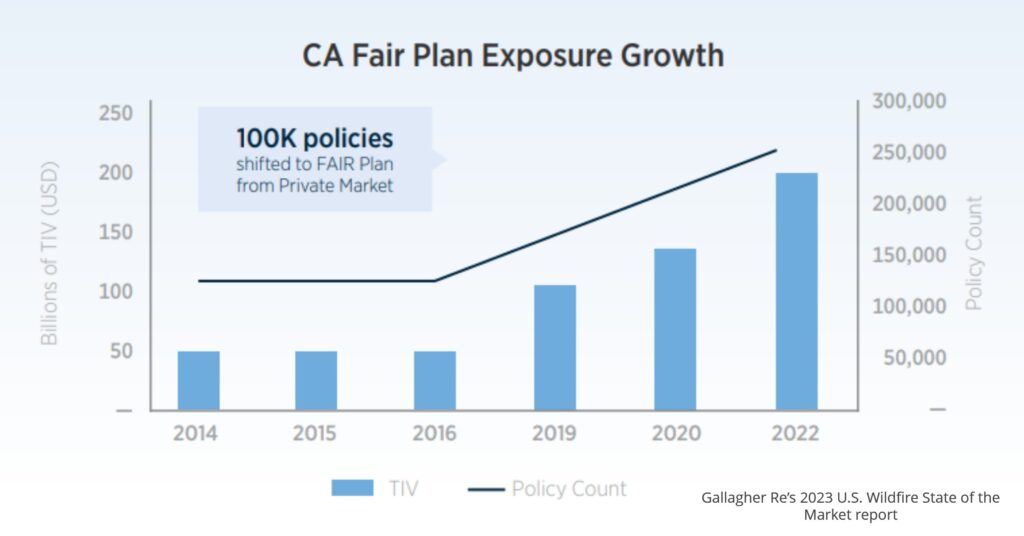

Consumers’ other option is the California Fair Access to Insurance Requirements Plan, the state’s insurer of last resort. The FAIR Plan provides basic fire insurance coverage for properties in high-risk areas when traditional insurers will not. Between 2019 and 2022, enrollment in the FAIR Plan grew 70% to include 272,846 homes.

“The California FAIR Plan’s rates have always been high,” adds Hebard-Summers. “However, with the influx of business it wasn’t a stretch for them to prove to the DOI that they will become insolvent in the event of a big catastrophe, so large rate increases were and are being granted quickly.”

Young calls the FAIR Plan “a thermonuclear weapon,” adding that “there’s currently $225 billion in insured losses on FAIR’s books. “It doesn’t have the reserves that insurers are required to maintain. It’s underfunded, and was never intended to be a long-term solution.”

Moving forward

Young says IIABCal continues to work toward solutions that he hopes will foster an environment more hospitable for insurers that still wish to do business in California. In any scenario, that will involve raising rates to prevent more insurers from rescinding availability across more lines of business – especially in property.

The bottom line, Hebard-Summers says, is that “admitted carriers can’t afford to take on any more risk at the rate levels they’re currently charging, no matter where the property is located.”

“One reason why this crisis of availability has grown over time is because it requires political action to resolve, and legislation to force the DOI to do something,” says Young. “No politician wants to put their name on a bill that’s going to raise people’s insurance premiums.

“The apocalyptic nature of wildfire exposure has changed the property insurance landscape in California forever,” he adds. “This crisis will continue so long as the DOI is focused on rate suppression, and not rate adequacy.”

Rene Swan is Renaissance’s Regional Executive Vice President, West.