As your independent insurance agency grows, your responsibilities as principal grow as well.

Handling the day-to-day can make it difficult to keep up with industry changes and focus on building proactive strategies. You often spend more time working in the business than working on the business. This can keep you from evolving and prevent you from maximizing your results and long-term growth.

So what is the solution many independent insurance agencies are turning to?

Aggregators and Networks.

An insurance aggregator (also known as a agency network or cluster), is a group of independent agencies that band together to combine premiums, giving its members the scale and advantages that are usually only available to the largest agencies. These advantages may include higher levels of commission, incentives, profit sharing, and more.

While there are many benefits to joining an insurance aggregator, not all agency networks are created equal. Each offers unique benefits and member services. We’ve listed a few key benefits below.

Access To New Markets

One of the most attractive benefits of joining an agency network is access to new markets and carriers. Without wide enough market access, you won’t be able to build a strong book of business because you won’t have the ability to provide the right options for your clients.

A network has the ability to step in and provide you with the market access you need.

Typically, gaining access to new markets is a difficult process for independent agents, requiring a significant premium threshold.

Strong agency networks like Renaissance can manage carrier relationships on behalf of their members, negotiating higher compensation and removing constraints like minimum premium volume.

The benefits of enhanced Market Access include:

- More choice and better value for your clients

- Increased close ratios for your producers

- Increased revenue for your business

- Improved customer service and higher client satisfaction

- Increased retention and more customer loyalty

Access To A Community Of Peers

As the old African proverb goes, “If you want to go fast, go alone. If you want to go far, go together.”

Choosing the right agency network can give you a lot more than just access to new markets. It can also provide you with a community of peers striving for the same goals.

Choosing the right agency network can give you a lot more than just access to new markets. It can also provide you with a community of peers striving for the same goals.

At Renaissance, our members receive valuable benefits when it comes to peer support, including:

- Networking and learning events

- Quarterly member meetings

- Topical member webinars and seminars

- A member advisory committee

The ability to interact with other insurance professionals can often lead to future partnerships, merger and acquisition opportunities, and feeling more supported by your fellow member agencies.

Whether you are a newer agent or a seasoned veteran, being part of a group of peers working toward the same goals can lead to significant growth.

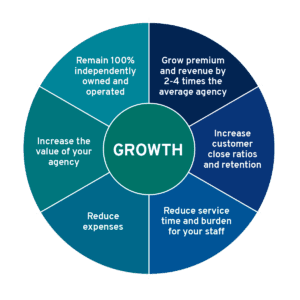

The Ability to Grow Your Agency

While some aggregators are formed only to give insurance agencies access to new markets and enhanced compensation, other networks are formed to support independent agents and help them grow their businesses. The partner you choose should be one that is most committed to helping your agency grow while remaining 100% independently owned and operated.

That means you need services that go beyond access to more markets and a community of peers.

Outsourcing of non-revenue generating activities

Your agency should be laser-focused on what it does best: selling insurance and providing great service. Time-consuming activities like billing, invoicing, and IT are usually best handled by outside experts. An agency network like Renaissance can help you offload these activities without the trouble of dealing with multiple vendors.

A Dedicated Agency Growth Partner

With Renaissance Alliance, you have access to a full-time team of experienced placement specialists to assist with renewals and find markets for complex risks. In addition, each of our member agencies is assigned a dedicated Growth Advisor to help them develop strategies for growth, benchmark their performance against industry peers, and fully utilize industry tools to strengthen their agency.

Technology, Data & Analytics

There’s marketable value hiding in your agency’s data. An agency network like Renaissance can help you maximize it.

Renaissance members are able to leverage our proprietary technology platform and reporting tools to spot inefficiencies and identify opportunities for financial growth. The platform includes dynamic book-of-business dashboards, a submission system with a small-commercial comparative rater, dedicated training services, and helpdesk support.

Maintaining Independence

Pay close attention to the details of any membership contract. As you explore your options, you’ll want to partner with a network that actually allows you to remain 100% independent and retain complete ownership of your agency. If you don’t have to pay entrance or exit fees, you’ll be at an even greater advantage.

Should You Join an Agency Network?

Independent insurance agencies are increasingly joining aggregators and networks, and for good reason. The right agency network can provide them with access to new markets at a higher compensation level than they would otherwise get on their own, access to a community of like-minded, growth-driven peers, and the ability to grow their agencies faster and more efficiently than they otherwise could.

All of this results in a larger book of business, higher levels of commission, and consistent, reliable revenue.

Ultimately, should you decide to join a group, choose one that is as committed to your growth as you are. The network you choose should act as more than just a tool for increased profits, but as a business partner dedicated to the growth of your insurance agency.