Independent agents need insurance tools that are fast, flexible, and easy to use. Inferior insurance agency management software drains resources, reduces efficiency, and limits an agency’s growth potential.

What makes this proposition tricky is that independent insurance agencies and technology often have a tough time getting along. Software for insurance agents isn’t always well-designed; carriers aren’t concerned with the agent’s experience in using them; and many of the legacy software providers in the industry prioritize flexibility over ease of use.

The right insurance software solutions, however, can help streamline and improve processes, streamline costs, and drive sales. Your agency will benefit from better security, accessibility, better customer relationships, and retention.

In this article, we’ll share with you the insurance agency software solutions that savvy agents use to power rapid growth.

The 9 Best Insurance Agency Software Tools You Should Be Using

1. Best Insurance Agency Management Systems

A reliable Agency Management System (AMS) is the foundation of any modern agency. From client records to renewals, carrier connectivity to reporting, these platforms streamline day-to-day operations and ensure your book of business is accessible and manageable.

AMS360 from Vertafore is a popular choice for commercial-focused agencies. Its deep carrier integrations and reporting capabilities make it a strong fit for those who prioritize back-office control, though the learning curve may be steep for newcomers. If you are a Renaissance member, we offer in-depth AMS360 training so you can get the most out of this powerful program and get your new employees up to speed quickly.

AMS360 from Vertafore is a popular choice for commercial-focused agencies. Its deep carrier integrations and reporting capabilities make it a strong fit for those who prioritize back-office control, though the learning curve may be steep for newcomers. If you are a Renaissance member, we offer in-depth AMS360 training so you can get the most out of this powerful program and get your new employees up to speed quickly.

Applied Epic remains the most comprehensive system on the market. Its cloud-native infrastructure and ecosystem of add-ons make it highly scalable for growing firms, though it often requires longer implementation timelines and more training than lighter platforms.

EZLynx caters to smaller or budget-conscious agencies with its combined rating engine and management system. While it may lack the deep customization of competitors, it remains easy to deploy and includes features like client portals and automation tools out of the box.

HawkSoft stands out for its user-friendly design and responsive support team. While it may not have all the bells and whistles larger platforms boast, many agents appreciate its simplicity and intuitive workflow, especially in personal lines.

2. Top CRMs for Insurance Agents

An effective CRM can transform how your agency manages sales, communication, and renewals. These systems help organize leads, track opportunities, and automate follow-ups that otherwise fall through the cracks.

AgencyZoom is designed specifically for insurance agents. It’s a favorite among growth-focused agencies thanks to its sales pipeline tracking, automation features, and onboarding workflows. While it doesn’t offer the depth of reporting found in enterprise tools, its insurance-native interface wins over many users along with its deep integration to Vertafore AMS360.

Salesforce is the gold standard in the CRM world, offering virtually limitless customization and automation capabilities. For larger firms with the resources to configure and manage it, Salesforce can powerfully centralize operations. However, its complexity and cost can be overkill for smaller shops.

ClientCircle, formerly Rocket Referrals, focuses on relationship marketing — helping agents automate check-ins, collect reviews, and stay top of mind with clients. It isn’t a full CRM in the traditional sense, but for customer engagement, it’s a powerful tool.

ClientCircle, formerly Rocket Referrals, focuses on relationship marketing — helping agents automate check-ins, collect reviews, and stay top of mind with clients. It isn’t a full CRM in the traditional sense, but for customer engagement, it’s a powerful tool.

Levitate reimagines CRM through a lighter-touch, “keep-in-touch” e-mail platform. Agents use it to maintain humanized contact with prospects and clients, though it’s not ideal for complex lead tracking or task management.

Agency Revolution blends e-mail marketing with CRM functionality, offering prebuilt campaign templates, reputation tools, and some cross-sell automation. It’s best suited for agencies that want a middle ground between marketing and sales tools without investing in multiple platforms. What takes it to the next level is a website and social media product that make it easy to increase organic leads and then contact them in a robust manner.

InsuredMine is a newer player offering a suite of CRM, marketing, and analytics tools made for insurance agencies. Its modern design and customizable dashboards make it appealing, although it may still be building brand awareness compared to the established players.

3. Cybersecurity Solutions for Insurance Agencies

Cybersecurity is no longer optional. Insurance agencies handle large volumes of sensitive client data and are increasingly targeted by phishing and ransomware.

Rhodian Group focuses on industry-specific cybersecurity services tailored for independent agencies. Their familiarity with insurance workflows allows them to offer practical guidance and implementation, though they may not offer the breadth of services a larger firm might. Their virtual desktop approach makes it easy to get back up to full productivity in the event of a disaster.

KnowBe4 is widely known for its employee training and phishing simulation programs. It helps agencies prepare their teams to avoid common threats, and while it doesn’t manage infrastructure security, it’s highly effective in reducing human error.

KnowBe4 is widely known for its employee training and phishing simulation programs. It helps agencies prepare their teams to avoid common threats, and while it doesn’t manage infrastructure security, it’s highly effective in reducing human error.

AppRiver offers robust e-mail security solutions including encryption, spam filtering, and continuity tools. It’s particularly valuable for agencies already using Microsoft 365, though it’s often paired with broader cybersecurity support for a more complete setup.

4. Insurance Analytics Tools for Data-Driven Decisions

The ability to interpret your agency’s performance in real time is a key differentiator. Analytics tools help identify growth opportunities, benchmark performance, and drive data-backed decisions.

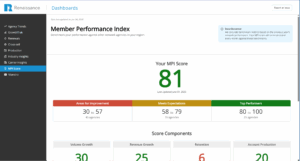

Renaissance Dashboards deliver industry-leading, actionable insights for our member agencies at no additional cost. These dashboards visualize production, retention, premium growth, and carrier performance across your book — without requiring complex setup or expensive data science resources.

Renaissance Dashboards deliver industry-leading, actionable insights for our member agencies at no additional cost. These dashboards visualize production, retention, premium growth, and carrier performance across your book — without requiring complex setup or expensive data science resources.

Applied Analytics is deeply integrated with the Applied Epic ecosystem, offering built-in reports and dashboards. It’s a logical fit for Epic users but not available as a standalone platform.

RiskMatch, a Vertafore product, provides advanced analytics with a focus on carrier relationships and benchmarking. It’s often used by larger agencies and networks who want to combine internal performance with external market data.

AgencyKPI was built for multi-location agencies and networks looking to compare performance across their footprint. Its visual dashboards and ability to standardize AMS data make it particularly appealing to those managing multiple books or offices.

5. Lead Generation Tools for Insurance Agents

Consistent lead flow is essential to agency growth. The right lead generation tool aligns marketing with sales and makes prospecting more predictable.

Zywave offers a broad suite of tools for marketing and client engagement, including prospecting databases and custom content. While its breadth is impressive, implementation may take time for smaller agencies.

Zywave offers a broad suite of tools for marketing and client engagement, including prospecting databases and custom content. While its breadth is impressive, implementation may take time for smaller agencies.

TrustedChoice.com serves as a national directory and lead provider, connecting high-intent consumers with independent agents. While lead quality can vary depending on geography and niche, it offers good visibility and supplemental opportunities.

Cold calling services remain a traditional but effective method, especially for commercial lines. Agencies should vet vendors carefully, prioritizing those with insurance experience and strong compliance practices.

6. Best Marketing Automation Tools for Insurance Agencies

Marketing automation tools help you stay top of mind with clients while increasing cross-sell opportunities and improving client retention.

Applied Marketing Automation integrates seamlessly with Applied Epic, enabling users to send personalized campaigns triggered by policy events. It’s best suited to agencies already operating in the Applied ecosystem.

Levitate excels at making communications feel personal, using lightweight “e-mail nudges” that help agents maintain client relationships over time. While not a campaign builder, it’s ideal for keeping a human touch in your outreach.

Levitate excels at making communications feel personal, using lightweight “e-mail nudges” that help agents maintain client relationships over time. While not a campaign builder, it’s ideal for keeping a human touch in your outreach.

Agency Revolution offers a library of e-mail templates, drip sequences, and customer journey automation specifically for insurance. It’s a powerful tool for staying consistent with renewals, reviews, and prospect engagement.

AgencyZoom also includes automation tools, particularly for onboarding and renewal reminders. These workflows are easy to set up and effective, especially when paired with its CRM features.

7. Best Digital Payment Solutions for Insurance Agencies

Digital payment tools speed up receivables, reduce friction, and modernize your client experience.

ePayPolicy is purpose-built for insurance agencies, offering quick setup and features like invoice tracking and integrated e-signature. It’s user-friendly and popular across both personal and commercial lines.

Applied Pay gives Applied Epic users an integrated payment solution that connects directly to the AMS, reducing reconciliation work. It’s ideal for those already committed to the Applied ecosystem.

Applied Pay gives Applied Epic users an integrated payment solution that connects directly to the AMS, reducing reconciliation work. It’s ideal for those already committed to the Applied ecosystem.

EasyPay is a general-purpose payment processor that supports multiple industries, including insurance. While not as tailored as ePayPolicy, it’s a viable option for agencies looking for flexibility.

IPFS TotalPay combines premium financing and payment processing into one system. It’s particularly valuable for agencies offering payment plans, though its core focus is financing rather than standalone processing.

Simply Easier Payments is another insurance-specific processor, notable for its ACH capabilities and ease of use. It offers strong support, though the interface may feel more dated compared to competitors.

8. Best Chatbots for Insurance Websites

Modern agencies use chatbots to handle after-hours inquiries, capture leads, and deliver quick answers without human intervention.

Zywave includes chatbot functionality as part of its broader engagement platform. It’s a good fit for agencies already using its content and client tools, though not sold as a standalone product.

Drift is widely known outside insurance and provides real-time website chat and lead routing. It’s highly customizable and feature-rich, though it may require technical setup for full deployment.

Drift is widely known outside insurance and provides real-time website chat and lead routing. It’s highly customizable and feature-rich, though it may require technical setup for full deployment.

Podium combines website chat with review management and SMS follow-up. It’s simple to implement and excels at mobile-first communication, though chatbot customization is somewhat limited.

9. AI Tools for Insurance Agents

Artificial intelligence is no longer experimental, it’s practical. From writing e-mails to summarizing client files, AI tools save time and improve accuracy.

ChatGPT has become a go-to for agents looking to draft client communications, create blog content, and generate scripts for quoting or onboarding. It’s not industry-specific, but adaptable with a bit of training.

Renaissance’s in-house AI tools take things a step further by leveraging insurance-specific data and built-in workflows designed to enhance agency productivity and decision-making. We’re actively embedding intelligent, time-saving AI features directly into the platform our members already use, eliminating the need for additional tools or integration headaches. This approach ensures our agencies gain the benefits of AI without adding complexity to their tech stack.

How Do You Select the Right Tech Solutions for Your Agency?

At Renaissance, we help agents simplify this process by focusing on solutions that actually drive revenue, reduce operational friction, and create meaningful time savings. The key to selecting the right software lies in evaluating its ease of integration, return on investment, training resources, and track record with other agencies.

There’s a Better Way.

Embracing change can be scary — and expensive.

Certainly, the insurance tools you’ve been using for decades have gotten the job done up to now — but insurance agent software that just gets the job done is nothing more than the bare minimum. Great software can help your agency go beyond what you thought was possible.

The right insurance agency software solutions can help you operate more efficiently, free up your team to work on revenue-generating opportunities, provide ease of use, and help you generate more premium — and, in turn, more revenue for your agency.

The right agency software can:

- Streamline and improve your processes for monitoring renewal deadlines and flagging cross-sell opportunities

- Help you promote your business and attract new customers

- Better serve more customers and prospects through video calls

- Expose opportunities that drive increased sales

- Simplify the process of quoting and submission placements

How Joining Renaissance Can Simplify Your Tech Stack

At Renaissance, we take the guesswork out of technology. From powerful dashboards to marketing platforms and adding built-in AI innovation, our platform brings together best-in-class tools — along with the support, training, and vendor discounts agencies need to thrive. You also gain access to a network of like-minded agencies who share what’s working in real time.

Let us help you simplify, scale, and succeed. Talk to our team today.