Are you still relying on standard commissions and volatile profit sharing to drive your insurance agency revenue?

Every agency needs to tap into as many insurance agency revenue streams as possible in order to maximize profitability and grow. Commissions and profit sharing are not the only way for agents to get paid, and will not maximize your potential earnings.

But what else is there, and how do you unlock those extra insurance agency revenue streams?

Below, we’ll review the four essential revenue streams every insurance agency needs. Before we dive in head first, let’s take a look at some of the reasons it’s important to diversify your income streams.

The Benefits of Multiple Insurance Agency Revenue Streams

The truth is, if you’re only earning from commissions and profit sharing, you’re leaving money on the table.

As you know, profit sharing is volatile and not something you can consistently budget for or count on every year. Unlocking multiple revenue streams can increase profitability and reduce your reliance on non-guaranteed numbers, reducing volatility in your agency’s performance and growth projections.

Plus, unlocking new revenue streams on its own is an avenue for growth. Simply tapping into these additional streams will increase the total revenue your agency generates. As your revenue increases, so does the value of your agency.

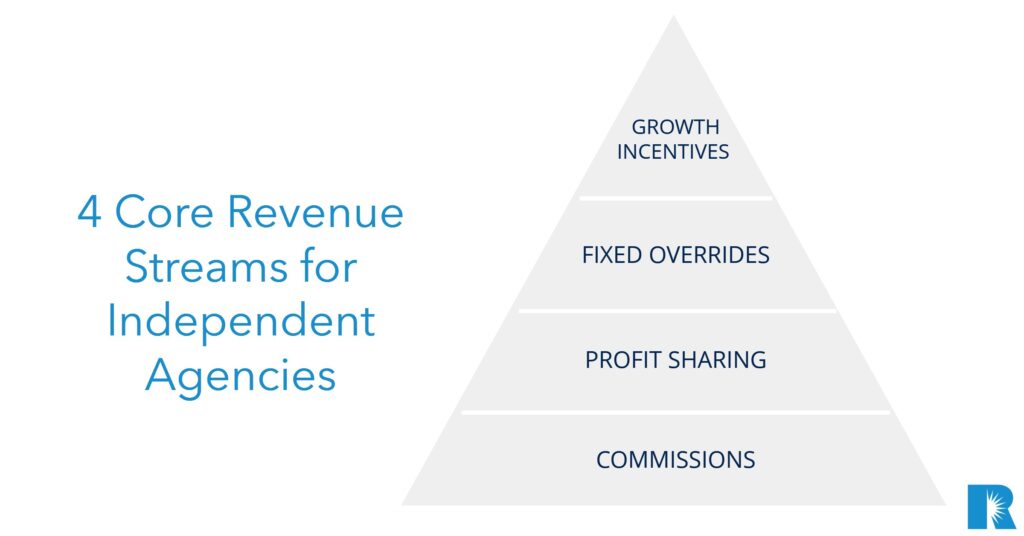

4 Critical Revenue Streams For Independent Agencies

Prioritize these four revenue streams to maximize growth:

1. Commissions

2. Profit sharing

3. Fixed overrides

4. Growth incentives

1. Commissions

At a successful independent agency, commissions naturally are the lifeblood of your organization and the lion’s share of your revenue.

Yet, did you know the best commission-earning independent insurance agencies are also members of an agency network like Renaissance?

Small independent insurance agencies typically have access to a select group of carriers. When agencies band together in a network, they can access more markets and carriers typically only available to larger agencies. This provides more options for clients, and in turn increases hit ratios, retention, and boosts sales and commissions.

2. Profit Sharing

Profit sharing revenue is variable income based on the specifics of the carrier contract, typically a combination of loss ratios and growth.

Because these factors change every year and often outside your control, your profit sharing likely fluctuates every year. As a result, it’s not something you can budget for or reliably count on. It’s likely you’ve had some highly profitable years, and others where you’ve earned significantly less.

Joining an agency network like Renaissance can help increase your profit-sharing revenue, delivering stability and and reducing year-to-year volatility.

You can also earn from the first dollar of premium with Renaissance’s carrier partners, allowing you to earn on all of your premium, not just the ones you’re large enough to qualify for on your own.

3. Fixed Overrides

Overrides are an additional revenue stream not available to most stand-alone agencies. These are fixed or guaranteed factors paid on all new and renewal business, in addition to standard commissions and profit sharing. Most stand-alone agencies aren’t large enough to negotiate these overrides with their carriers.

Joining an agency network like Renaissance also gives you access to these fixed overrides on all new and renewal premium with multiple carrier and wholesale partners. This allows you to add a more reliable revenue stream in addition to commissions and profit sharing.

4. Growth Incentives

Incentives are a common tool used to boost sales, so it’s no surprise that it’s one of the potential revenue streams available for savvy insurance agencies.

Negotiating growth incentives based on new business production or overall book growth is a great way to add additional revenue to your agency. Most carriers only do this for agencies that possess a certain size or profitability of book, so they may or may not be available to you as a stand-alone agency.

You get the best payouts for growth incentives when you work with a partner like Renaissance that’s able to broadly negotiate with many carriers on your behalf.

Strength (and Profitability) in Numbers

Growth-focused independent insurance agencies need to tap into as many revenue streams as possible in order to maximize profits, and experience less fluctuations in income.

To summarize, agents should be earning:

- Commissions — standard or enhanced.

- Profit sharing — volatile revenue based on carrier contract factors, usually loss ratio, growth and size.

- Fixed overrides — extra income on all new and renewal business.

- Growth incentives — additional bonus revenue earned if you hit certain negotiated growth targets.

If your agency is seeking ways to further maximize revenue potential and ready to take full advantage of these four revenue streams, consider membership in an agency network like Renaissance.