Deciding the future of your agency depends entirely on one thing: how much you want it to continually grow.

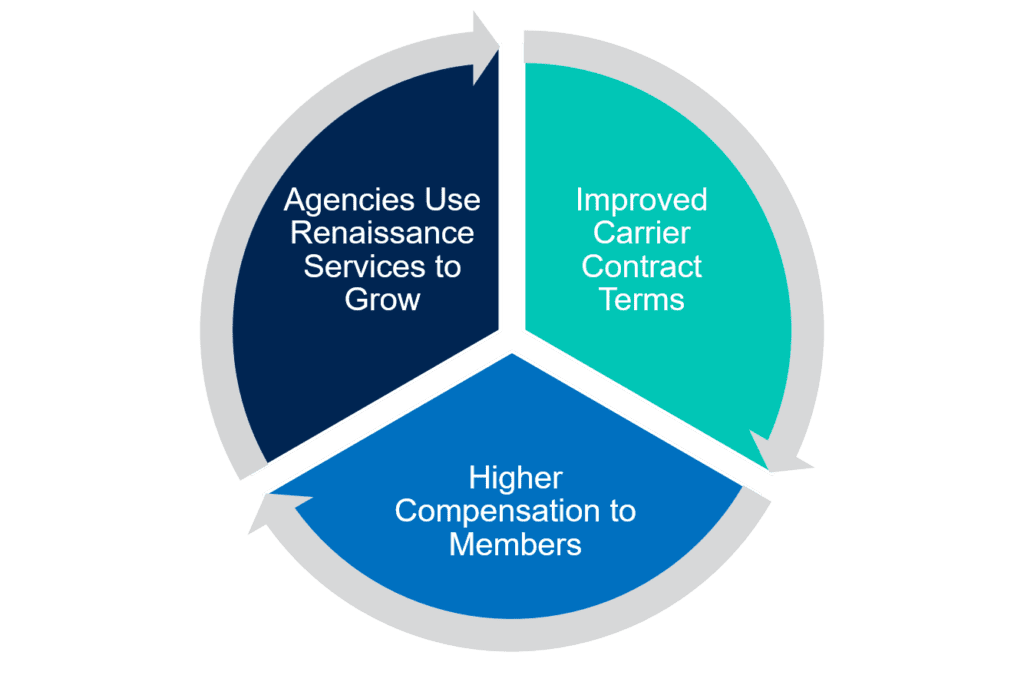

In a previous post, we mentioned a process called “The Virtuous Cycle,” and how independent agents can make it work for them – provided they want to move beyond the limits afforded by commission clubs.

Here’s what the “Virtuous Cycle” involves: When our members are empowered to grow at 7% a year organically, that means our carrier partners are likewise growing at 7% – and our average member grows at least 6% to 7% per year. The organic growth rate of members on our platform is double or more the growth rate of all the other agencies that operate on their own.

Every time our members grow premium by $1 million, they get $130,000 of revenue (your average standard commission being 13%) — and that’s likely to be a 9-to-12-year revenue stream. It’s the gift that keeps giving.

Every time we can drive that growth rate up, our carrier partners become happier. They pay us more, which means our agents get more. So our agents are growing faster than average, they’re getting paid more than average – and then, more agencies want to join our platform, which keeps the Virtuous Cycle going.

And it all begins with us being able to drive organic growth.

Download our free e-book here: The Independent Agent’s Playbook for Success – How to Solve Your Agency’s Five Biggest Challenges

Renaissance Alliance offers agencies even more leverage than those in commission clubs are currently enjoying, plus the tools they need to accelerate their growth. Our members have a 20-year record of extraordinary profitability as a whole.

On average, enhanced commissions alone are close to a 5% split with our agents – more than twice the average 1% achieved elsewhere. On top of that, we offer our members a customized growth plan to drive growth levers. We assist those agencies in achieving this by helping them increasing overall retention rates; increasing policies per customer through cross-selling and account rounding; increasing their close ratio on new business opportunities; and through increased lead generation.

Our degree of influence with carriers alone is worth far more than a single point on commissions.

For those concerned with market access, we deliver products and expertise to drive new account writings, especially in Commercial Lines. Personal and Commercial Lines placement specialists aid your access through our master codes with full commissions, at no cost to you, including out-of-state placements.

Technology and analytics empower agencies with powerful software tools to drive growth decisions. And in this case, “powerful” doesn’t mean “complicated.” Our user-friendly dashboards and daily reporting tools put technophobes at ease.

Additionally, we improve operational efficiency and expense management with repurposing staff time, vendor discounts, and cost savings.

There’s much more to it, including marketing services that boost your branding and digital presence, and revenue-growth tools that offer wider access to E&S as well as standard carriers with higher compensation and fixed overrides.

Commission clubs, on the other hand, have the opposite of the Virtuous Cycle: They have the Distressed Cycle. They’ve got an array of members, all of which are growing at the same, distressed rate of 2% to 2.5% a year at maximum. Think about that for a second: If you had your 401k being managed by someone who only grew your portfolio at 2.5% annually, they wouldn’t have your money for very long.

As we noted previously, it will not be a surprise if over the next five years, many carriers stop paying enhanced commissions to commission clubs because they aren’t providing value to the insurer that actually increases over time. Several key carriers are already reviewing and reassessing those profit-sharing and compensation agreements.

Simply put, we have a value proposition where our carriers love what we do and are willing to pay for it. The key for you (and this is central to the Virtuous Cycle) is organic growth, enhanced profitability – which in turn enhances the overall value of your agency.

We also have a significant business-transfer capability that allows us to move business away from our non-key partners to our key partners.

Independent agencies value their independence above all else, and we understand that completely. No one in our network loses control of their business. Our members grow premiums and revenue and increase both their operational efficiency and their value while staying independently owned and operated.

Choosing a new path

Revenue growth, premium growth and operational efficiency are what your agency deserves, not a single point for just cruising along. It’s a better proposition than risking your business’s future.

Ultimately, the question is this: As an agency principal, are you content to remain part of a commission club, or are you interested in becoming part of an agency network that’s dedicated to accelerating your business, preserving your legacy, and involving you in a Virtuous Cycle in which everyone benefits?

If you’re thinking of the latter, there’s no better time than now.