Independent insurance agents need agency software tools that are fast, flexible, and easy to use. Inferior tech drains resources, reduces efficiency, and limits an agency’s growth potential.

What makes this proposition tricky is that independent insurance agencies and technology often have a tough time getting along. The software solutions that agents use aren’t always well-designed, carriers aren’t concerned with the agent’s experience in using them, and many of the legacy software providers in the industry prioritize flexibility over ease of use.

The right insurance agency software tools, however, can help streamline and improve processes, streamline costs, and drive sales. Your agency will benefit from better security, accessibility, better customer relationships, and retention.

In this article, we’ll show you the software tools smart insurance agencies use for rapid growth.

First, we want to share our best tips for a seamless transition to newer, more efficient agency software.

What is Insurance Agency Software?

Insurance agency software powers the systems that help insurance agencies or brokerages manage their day-to-day operations online.

From an administrative point of view, various types of software can help an insurance agency’s staff access client data; manage leads, prospects, products, and quotes; and track policy and claims information.

On the customer side, insurance agency software enables your customers to log in and fill out forms, check their policy information, make online payments, and perform other actions on your agency website.

Possessing functionality for both business process management (BPM) and customer relationship management (CRM), insurance agency software serves as the means to facilitate all of an agency’s primary business processes.

What are Insurance Agency Management Systems?

Simply stated, insurance agency management systems (AMS) provide solutions to help insurance agencies manage their day-to-day business.

Insurance agency management systems perform several primary functions. At a minimum, they:

- Store information on all of the agency’s clients, including policy documents and statements

- Deliver reporting tools for monitoring sales performance and tracking an account’s status

- Provide features for streamlining or automating agency workflows

Combining the capabilities of customer relationship management (CRM) software and marketing automation software, agency management systems assist in managing relationships with clients, customers, and prospects. They also deliver automated solutions to streamline agency back-office tasks such as bookkeeping, generating quotes, commission processing, and sending email marketing campaigns, to name a few.

An agency’s embrace of AMS depends entirely on its needs. If an agency just wants to use it for bookkeeping and policy management, an out-of-the-box, basic system will often fit the bill. If the agency wishes to automate various back-office tasks such as real-time quoting, processing payments, or targeting prospects with email marketing campaigns, then a more extensive setup, integration process, and a training plan will be required.

Benefits of Insurance Agency Software

With the right insurance agency software solutions in place, manual processes can be left behind and your business can gain new benefits and efficiencies. These include:

- More efficient operations. Tons of time can be saved by having all of your customer information in a single database, and enabling your staff to automate tedious processes like billing and reporting.

- Better customer service. Customers want the flexibility to pay online and perform self-service tasks, and they expect your agency to stay on top of renewals. The proper software helps you do those things and so much more.

- Improved communications. Automatic notifications, communication tracking, and other features can ensure nothing gets lost in translation when dealing with clients or your carrier partners.

- Up-to-date regulatory compliance. Software tools can help you stay in step with evolving state and national regulations for your customers that could have turned into expensive oversights if you’d missed them.

- Enhanced data security. Encryption and user-authentication features help keep your clients’ sensitive customer or carrier information safe.

5 Tips For Integrating New Software into your Insurance Agency

Agencies often resist technology changes because they are afraid of major glitches when they transition to new tools. However, it doesn’t have to be that way. Here are some tips to help you get set up smoothly:

1. Don’t overhaul everything all at once. Make changes slowly across departments.

2. Ensure your employees understand what changes are being made to your software toolkit, why they’re happening, and how you’re going to be supporting them during the adoption process.

3. Put customer service first and train your staff accordingly.

4. Provide the necessary resources needed to make the transition. Do you need computer upgrades? Make provisions for that.

5. Appoint a key person to supervise and coordinate the changes.

One more bonus pro tip: Join an Agency Aggregator like Renaissance Alliance that specializes in technology to guide you through the transition.

The Best Software Tools to Make Your Insurance Agency More Money

Here are some of our best software picks to help you collaborate better, sell more, manage your agency more efficiently, and grow faster.

Marketing Tools

One of the most common inquiries from agency owners concerns marketing tools, specifically customer relationship management. While there are big, well-known players in the market like Salesforce.com, these tools generally have more firepower than the average insurance agency needs.

Here are a few recommendations that create a faster path to growth for insurance agencies, from advertising tools to contact management and engagement software to help with cross-selling and retention.

Best Insurance Agency Management Software

While the names of some of the following tools might sound familiar, others may be new to you. It’s wise to first do your due diligence and determine precisely what your agency’s needs are, so that you can approach the various products available from an informed perspective on what capabilities your business requires most.

1. Levitate / AgencyZoom / Agency Revolution

One of the most important elements of the independent agency world is customer engagement. Which tools exist to help you and your staff manage all aspects of your customer relationships? How can you ensure you’re doing everything in your power to keep them active and engaged?

Levitate, AgencyZoom and Agency Revolution are three of the most commonly used insurance agency-specific customer engagement tools available. Each tool can help you keep track of your recent touchpoints with each customer, provide context on what your conversations have centered around, flag when key renewal deadlines are approaching, and remind you to reach out in advance.

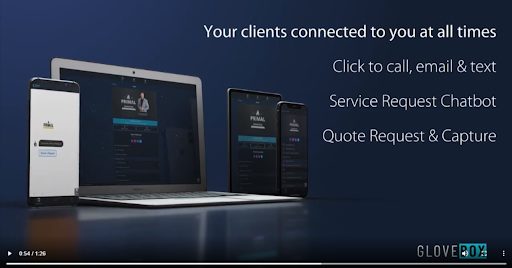

2. Glovebox / Relativity6 / Podium

Cross-selling, customer engagement and customer retention are all at the core of a successful independent insurance agency. The more engaged your customers are, the more likely they are to renew when the time comes – and the more likely they are to be receptive to cross-selling opportunities.

These software tools help you navigate all three pieces of that puzzle.

Glovebox empowers the customer with self-service, but keeps the agent at the center of the transaction. Relativity6 helps agents engage with customers by surfacing information about them to help with cross-selling and retention. Podium is a texting platform that also enhances an agency’s digital presence.

Best Insurance Agency CRM software

CRM software helps you better understand your client relationships, what they’re interested in and how they behave, which in turn makes it easier to retain them when policies are up for renewal. Here are some of the best options to consider.

3. HubSpot / Pipedrive / Copper

Because of its ability to integrate with your website and create the foundation for an effective content marketing machine, HubSpot is one of our favorites, but we’d recommend taking a look at all three of these solutions to determine which is best for your agency.

Whichever CRM tool you implement, remember that you should always take a client-first approach to data collection in order to build trust with your clients. The process and discipline you institute to enforce usage of the CRM is more important than which system you choose.

The main point of using a CRM in the first place is to measure prospect and customer engagement. Once something can be measured, opportunities to improve can be identified and alternative approaches can be tested to understand what works best for you and your customers.

Best Insurance Agency Marketing Software

Direct writers spend billions per year on their marketing efforts, so it’s in your best interest to differentiate yourself in a crowded marketplace. Here are some of the best tools to consider.

4. Mailchimp / Constant Contact / ActiveCampaign

Despite all the trendy new social media, email is still one of the most effective marketing channels and Mailchimp, Constant Contact, and ActiveCampaign are some of the best email service providers out there.

To be successful with email marketing in the insurance industry:

-

-

- Diversify the content you’re sharing beyond just sales-focused emails.

- Segment your list based on contact behavior or demographic details for better personalization and a higher likelihood of conversions.

- Only email people who have given you permission to do so.

-

5. Google Ads / Facebook Ads

Ads are a faster way to get eyes on your offerings. Even better, digital ads like Google and Facebook ads are more cost effective than traditional ads, and they often deliver better results.

Remember that ads are better suited for making sales rather than brand awareness. Before you start research and understand your target audience, create goals for separate campaigns, create a specific landing page for your ad, and invest in great ad copy.

Why should you care about marketing tools?

Promoting your services, building and maintaining great relationships with customers and prospects, and measuring results along the way to uncover areas where you can improve are all critically important to the success of your agency. These tools can help you achieve each piece of this puzzle.

Growth-Focused Tools for Insurance Agencies

Beyond the marketing and customer-engagement elements of your agency, you also need to have tools at your fingertips that can directly help you grow your business. The tools in this section do exactly that.

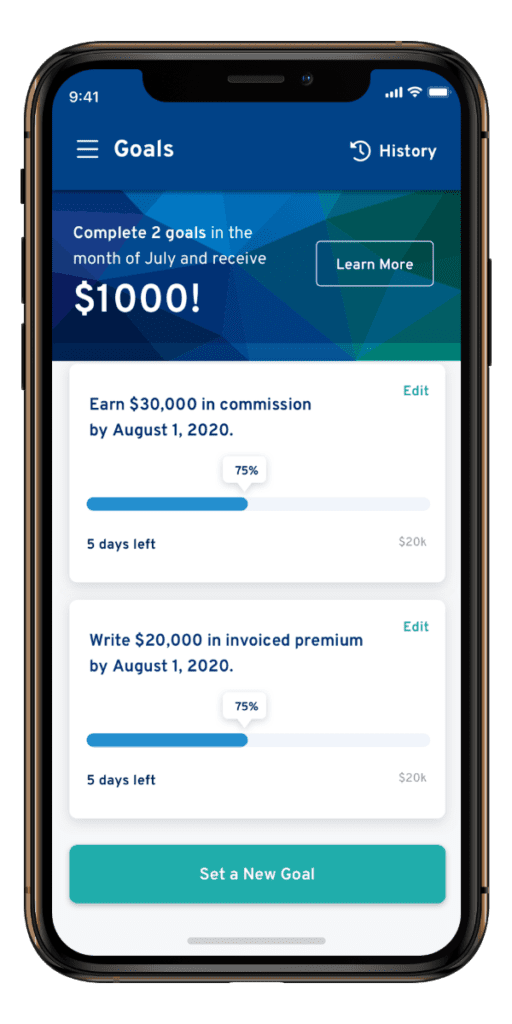

6. Arno: the mobile app for agency principals from Renaissance Alliance

Arno is a Renaissance Alliance member-exclusive mobile app that helps agency principals quickly find and flag opportunities for revenue growth, policy renewals, goal setting, and tracking.

At its core, Arno helps independent agency principals with four important tasks:

1. Look backward: Explore what happened yesterday, last week, last quarter, etc. within your agency.

2. Look forward: Identify ways to increase revenue in the future: think upcoming renewals, cross-sell opportunities, win-back opportunities, etc.

3. Take action: Seamlessly reach out to your team and your customers.

4. Set goals: Identify and track progress toward key objectives for your agency.

Arno surfaces the things happening in your agency that are most important to you: high-premium renewals, recently lost accounts, ways to optimize your agency’s revenue, and more.

The “What happened yesterday?” module shows new and lost accounts and policies. Under “What can I do today?” you’ll find revenue opportunities your agency can capitalize on, while the policy and account flagging feature allows you to flag an account or policy for follow-up.

7. Portico: a submission system and small commercial comparative rater

The process of quoting small commercial business has long been laborious, but a wave of innovation in the last several years is working to change that. Companies like Semsee, Thimble, and a long list of others have made great progress streamlining this process. This is a fast-changing area of the InsurTech world, but finding a company to partner with can bring lots of time savings to this process.

Renaissance Alliance members can streamline the small commercial submission process using Portico.

Portico provides two paths to placing a submission.

1. The first is a traditional path, leveraging the Renaissance Placement Services group to help find the best market for a risk and transfer the transactional work to Renaissance, leaving your staff with more time to engage with customers.

2. The second is an automated path that returns multiple quotes immediately within one application for small commercial business.

The combination of these two paths provides a powerful resource to Renaissance members. These agencies have streamlined the placement process so they can keep staff focused on writing new business and retaining customers, rather than administrative activities.

Why should you care about agency growth tools?

Agency growth software is designed to reveal growth opportunities for your business. Great software should surface these opportunities to you and help you take action (i.e., Arno). It should also make your processes easier, not more cumbersome.

Collaboration Tools for Insurance Agents

Collaboration is crucial for any business, especially when working remotely. The following tools make it easier to organize, communicate, and collaborate with your team members and clients.

8. Slack / Microsoft Teams

Effective communication is a must for any growth-centered insurance agency. That’s where tools like Slack and Microsoft Teams come in.

These tools help bring your team together, with channels to organize work, face-to-face chat, and even collaborate with other companies. Instead of having to email your team individually to delegate tasks or share quick context updates, you can post a message on the relevant channel and everyone is notified. In addition to increasing the speed of doing business, these tools can help to automate workflows and create accountability within your team.

9. Asana

Asana is a project management tool that teams can use to keep track of all the moving parts of the business. While workflow is often the major pain point in an agency, all businesses have a need for project management. Without a tool like Asana, your team could be dropping the ball and leaving to-do’s unchecked without even realizing it.

Asana provides robust features that create accountability within your agency while delivering a simple and intuitive interface. You have the option to break work into tasks and subtasks that show additional steps to complete a bigger task. One of our favorite features lets you assign work so everyone knows who’s responsible for it.

Ready-to-use templates provided by Asana allow you to start planning and managing your project immediately. You can leverage Asana forms to create tasks for individuals or teams, and each task works seamlessly with email.

To get the most out of Asana, make sure to use the integration feature. You can have Asana working in sync with Gmail, Microsoft Teams, Zapier, or whatever work tools you use most. Asana can also become a powerful management tool when accompanied with Everhour to monitor time spent on critical activities.

Why should you care about collaboration tools?

The truth is, these tools are table stakes for any modern small business. Project management and collaboration tools increase the speed of business, help automate workflows, and allow you to more easily measure progress.

Wrapping Up

Embracing change can be scary – and expensive.

Certainly, the tools you’ve been using for decades have gotten the job done up to now – but software that just gets the job done is nothing more than the bare minimum. Great software can help your agency go beyond what you thought was possible.

The right solution can help you operate more efficiently, free up your team to work on revenue-generating opportunities, provide ease of use, and help you generate more premium – and, in turn, more revenue for your agency.

The right agency software tools can:

- Streamline and improve your processes for monitoring renewal deadlines and flagging cross-sell opportunities

- Help you promote your business and attract new customers

- Better serve more customers and prospects through video calls

- Expose opportunities that drive increased sales

- Simplify the process of quoting and submission placements

As a next step, we recommend choosing one or two tools from this list as a starting point. Sign up for a free trial, request a demo, or just do some digging on what’s possible within the tools and how it could help your business.

If you are ready to take things further and invest in growing your agency, reach out to the Renaissance Alliance team today to talk about how you could be using Arno and Portico to help grow your agency.